Product Disclosure Sheet

Please read this Product Disclosure Sheet before you (“The User”) decide to sign up for a Setel account. Be sure to also read Setel Group’s Privacy Statement and general Terms and Conditions.

i. Treat Customers Fairly Charter

Setel Ventures Sdn. Bhd. (“Setel”) and the Setel Group are committed to deliver good financial consumer outcomes to our customers. We believe in building long-term and mutually beneficial relationships with our customers and hereby pledge our commitment to provide the highest standards of fairness in all our dealings with our customers.

To keep our customers’ interests and financial well-being protected, we at Setel commit to the following:

- To embed fair dealing into our company’s corporate culture, code of conduct and core values;

- To ensure that customers are provided with fair and transparent terms which are well communicated to customers;

- To ensure that our staff, representatives, and agents exercise due care, skill and diligence when dealing with customers; and

- To ensure that customers are provided with clear, relevant and timely information on financial services and products.

Pursuant to the above, Setel has set out relevant and timely information of our products and services offered on the Setel application to help our customers make an informed decision on our current and upcoming offerings.

ii. Product Disclosure – Key Features

1. What is this product about?

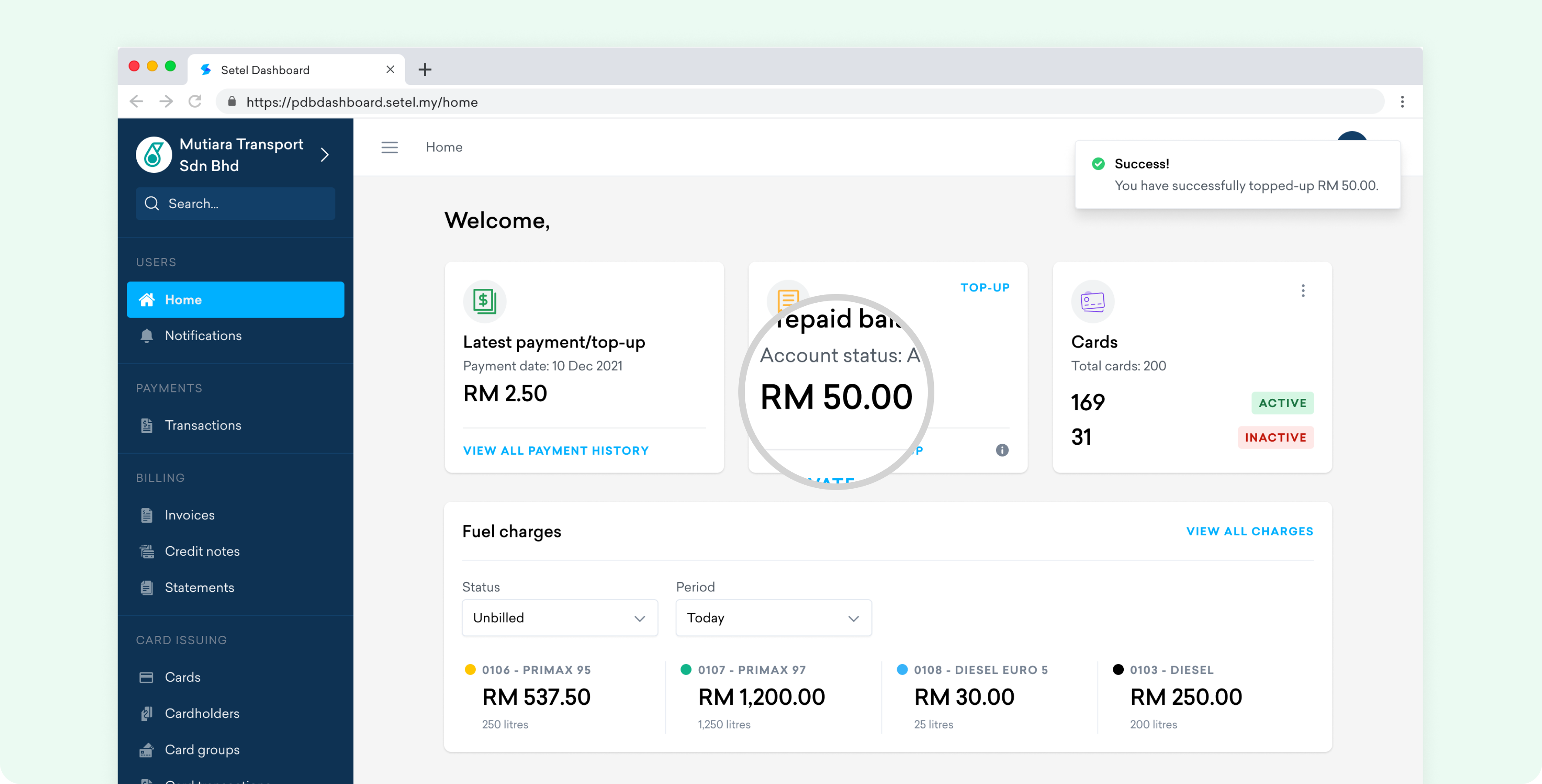

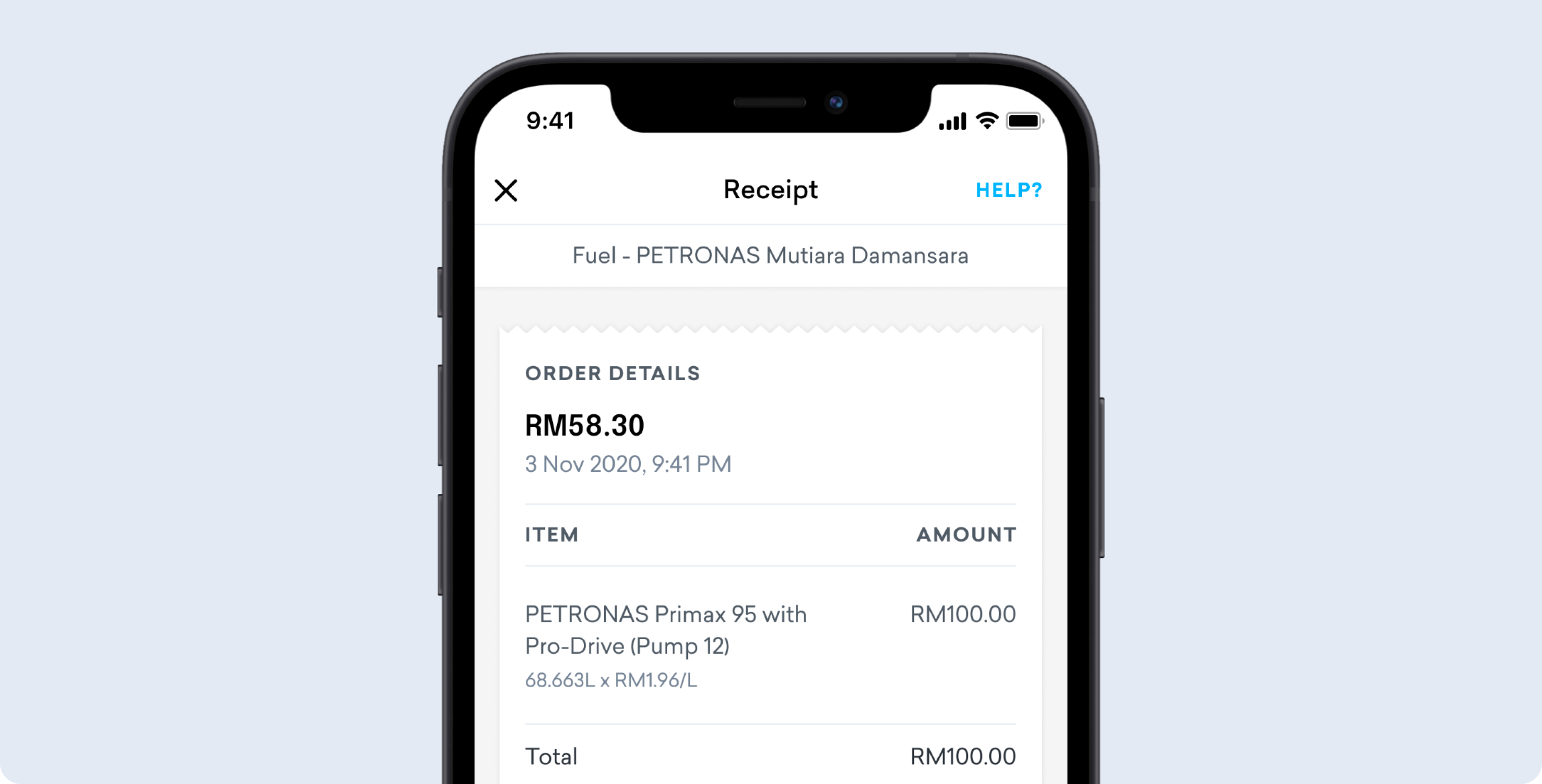

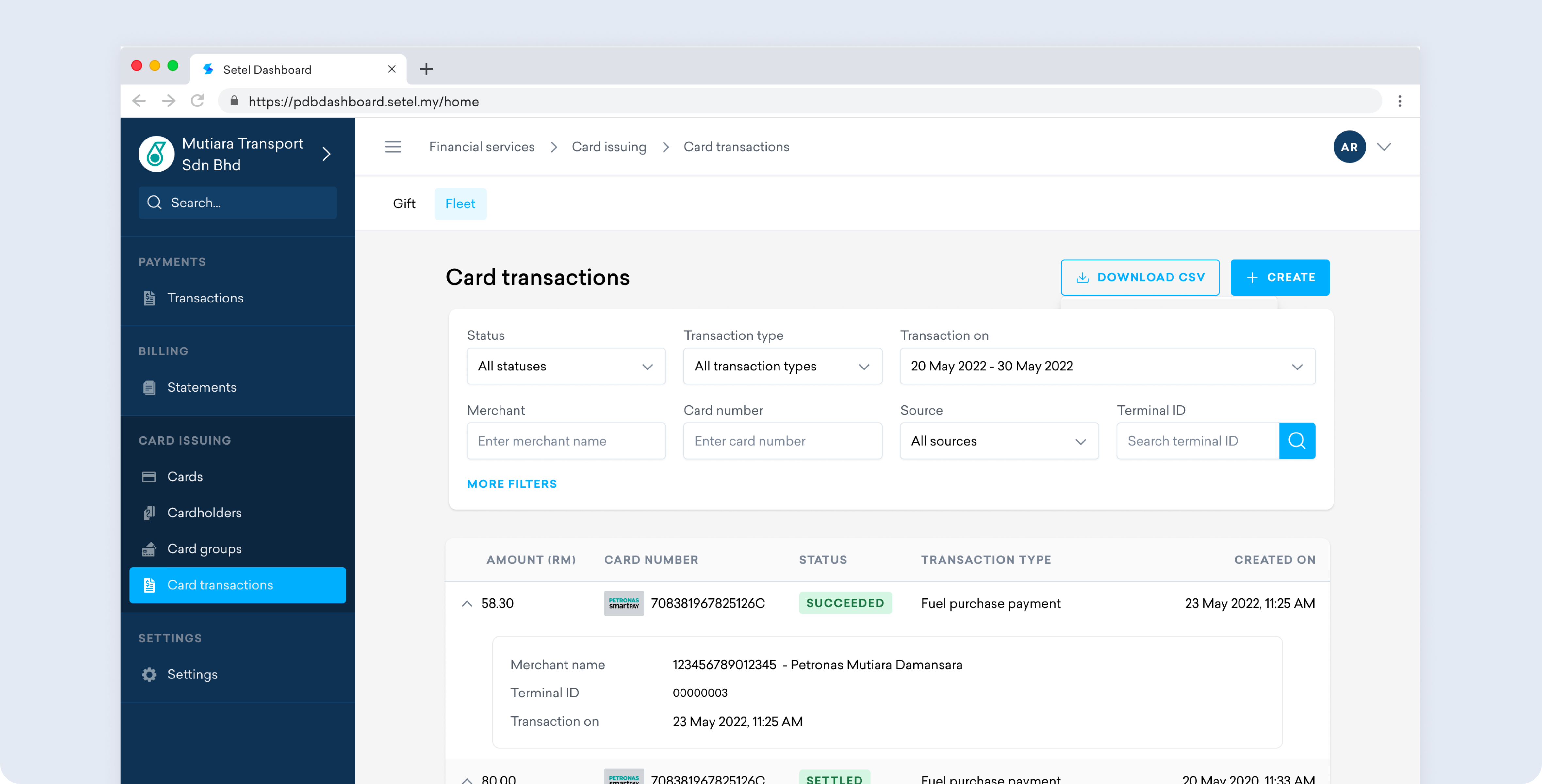

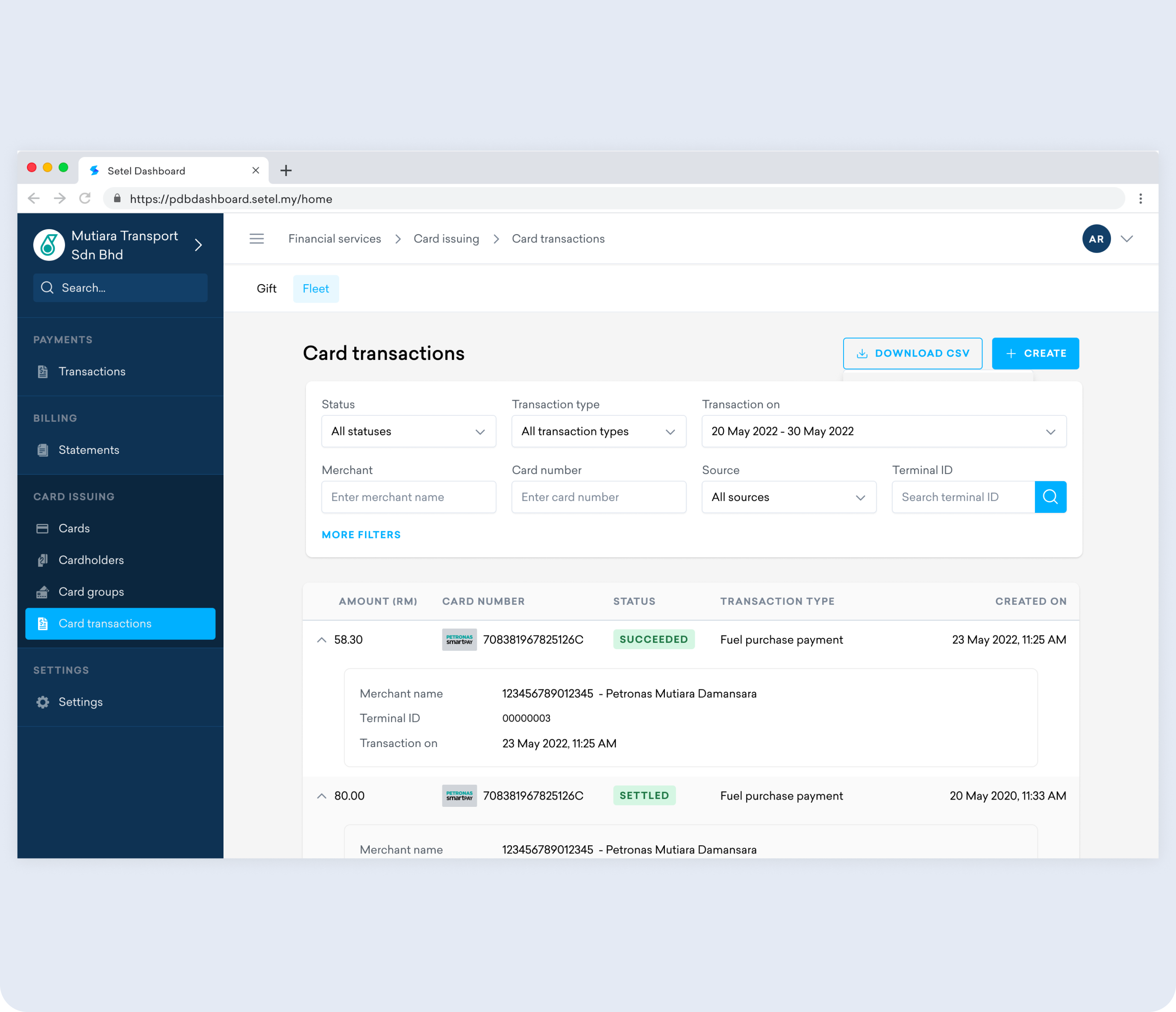

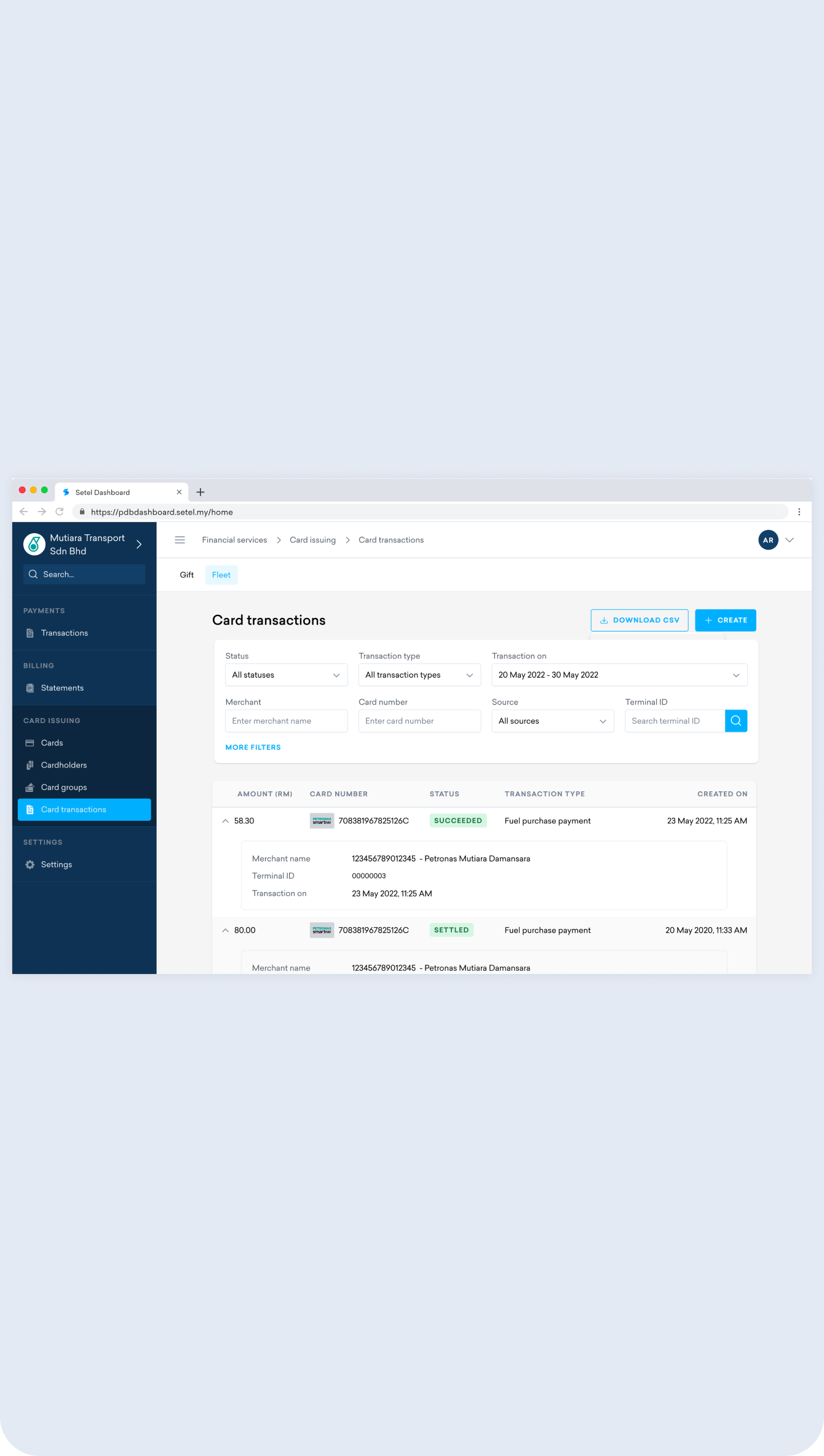

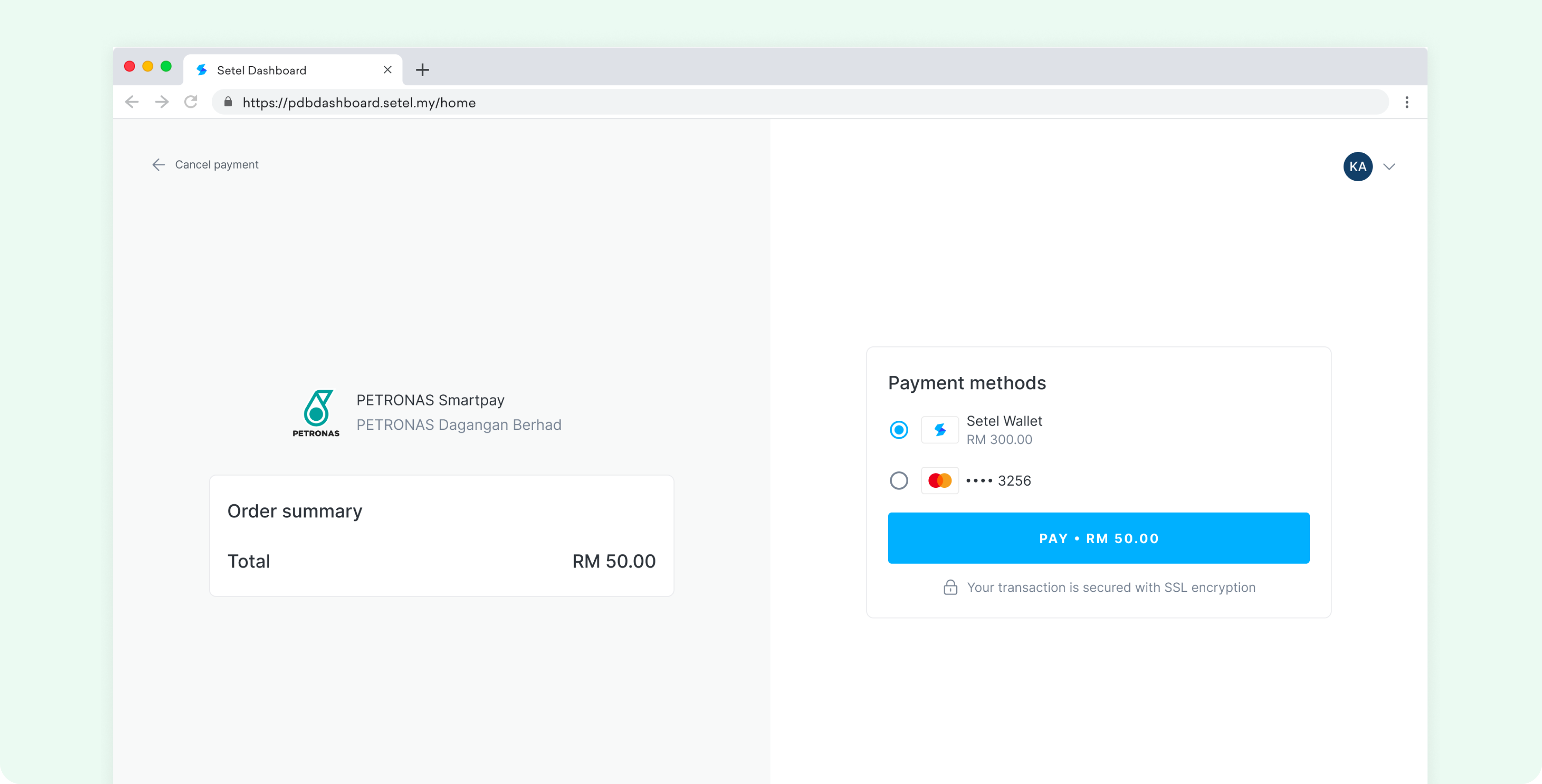

Setel Ventures Sdn. Bhd. (“Setel”) is offering prepayment services via our electronic money application or electronic wallet namely, Setel Wallet. Customers can use Setel Wallet to pay for their fuel purchases at PETRONAS stations, payment for items sold in Kedai Mesra and other retail purchases from participating merchants at their physical or online store.

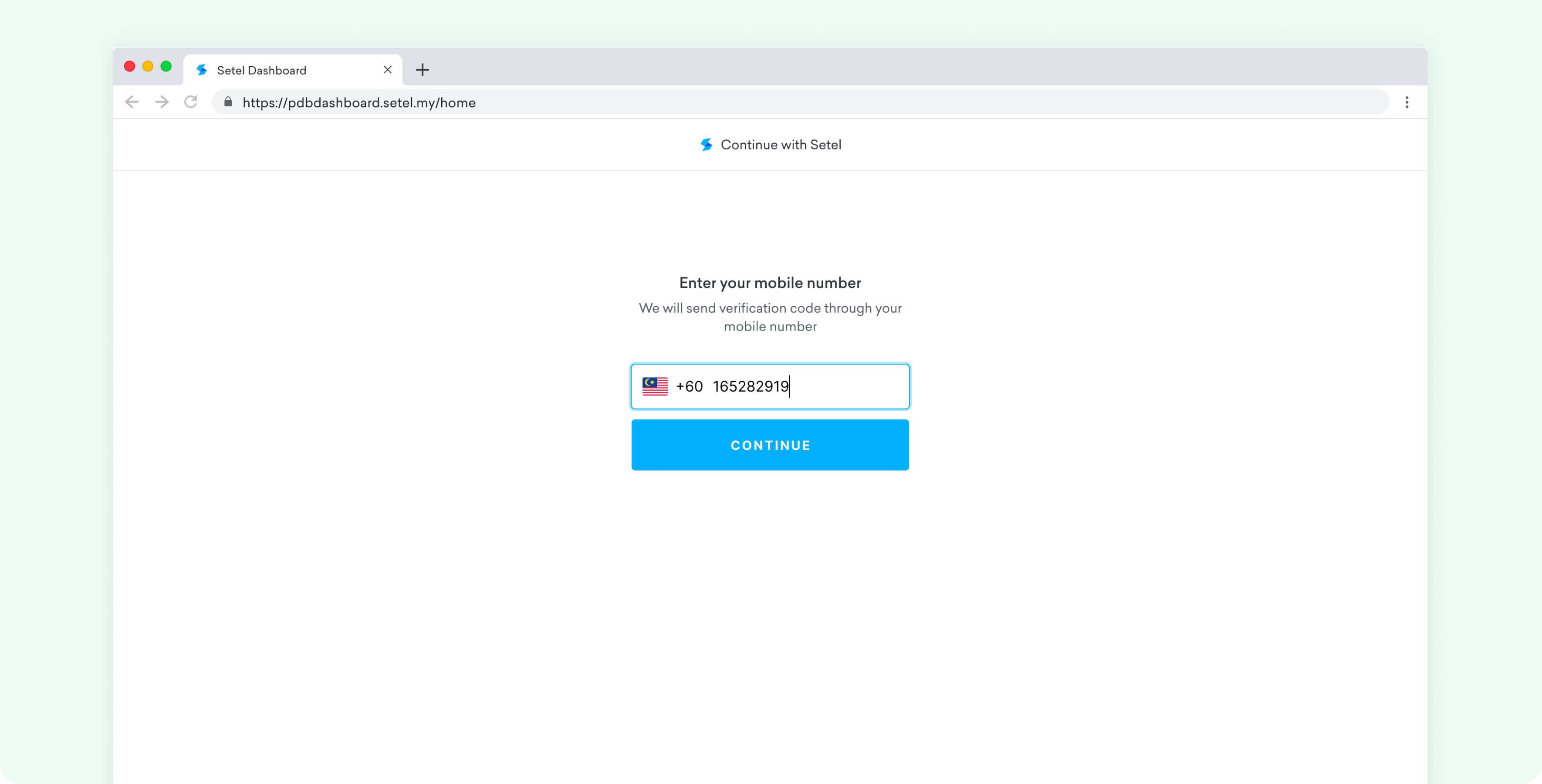

Customers can download the Setel mobile application from the Apple Store, Google Play Store or HUAWEI App Gallery and register to become a user (“The User”) to enjoy the benefits such as not having to queue up at PETRONAS stations to refuel their vehicles, to purchasing items from Kedai Mesra conveniently from their car seats, as well as making purchases from participating merchants.

Customers can reload their Setel Wallet via;

- Credit card: Top up using Visa or Mastercard;

- Debit card: Top up using debit card issued by domestic banking institutions;

- FPX: Top up using internet banking channel;

- Boost Wallet; online top-up using Boost Wallet;

- GrabPay; online top-up using GrabPay Wallet;

- ShopeePay; online top-up using ShopeePay Wallet;

- Setel Vouchers; or

- Mesra points.

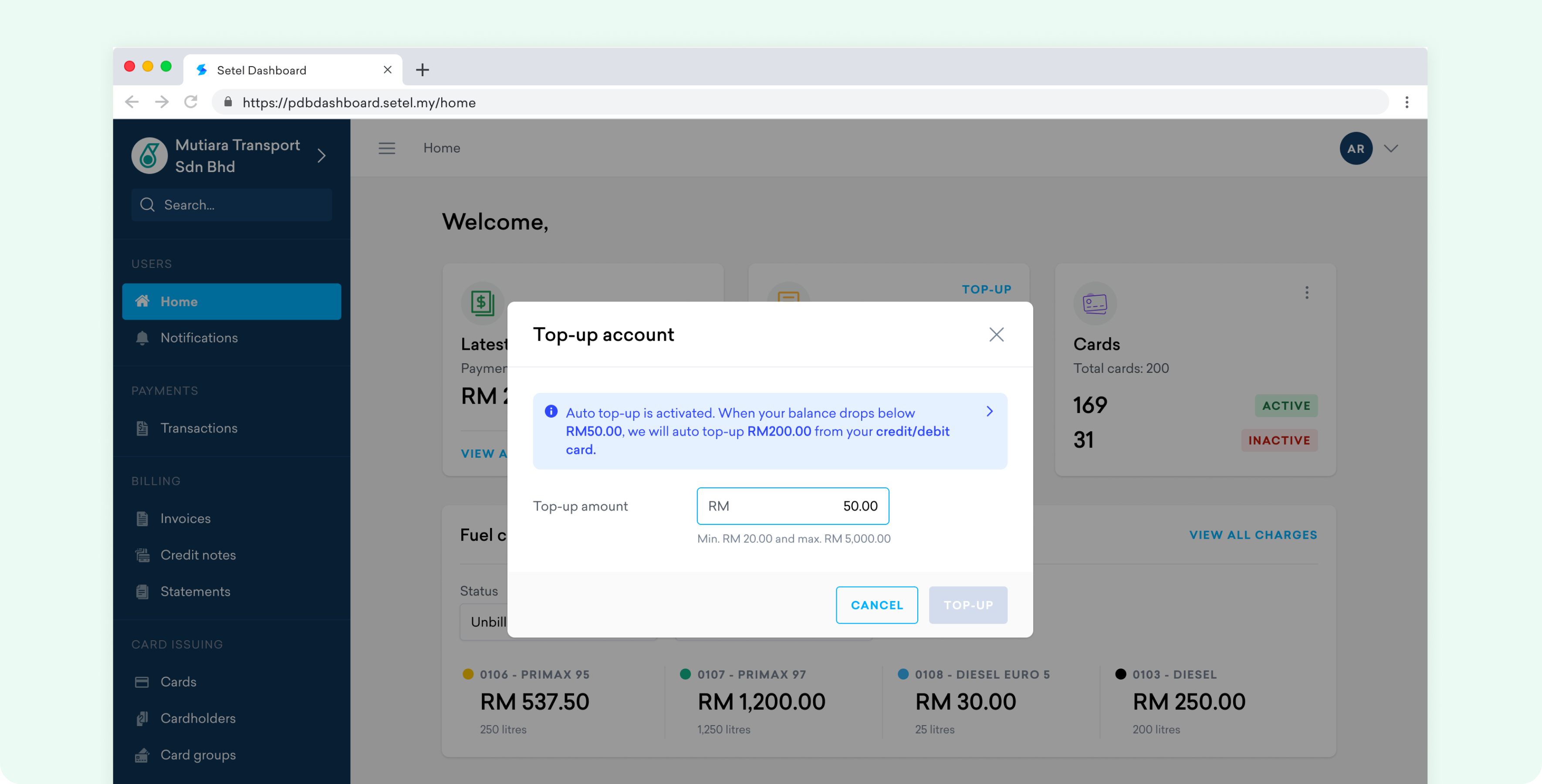

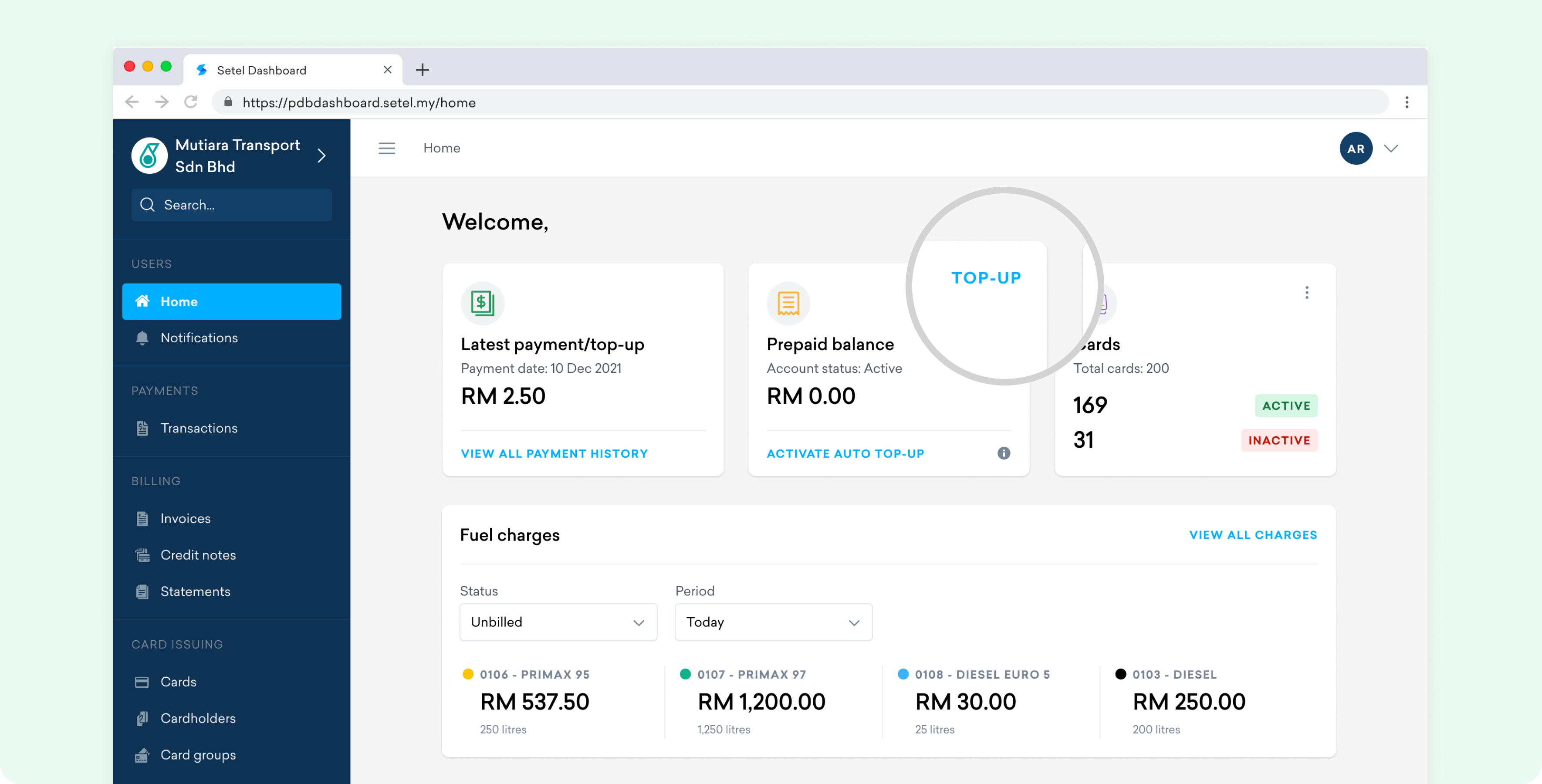

Reload of the Setel Wallet can be automated using a credit card or debit card with the auto top-up feature. The cap on the reload is based on the threshold set or a one-off reload transaction limit.

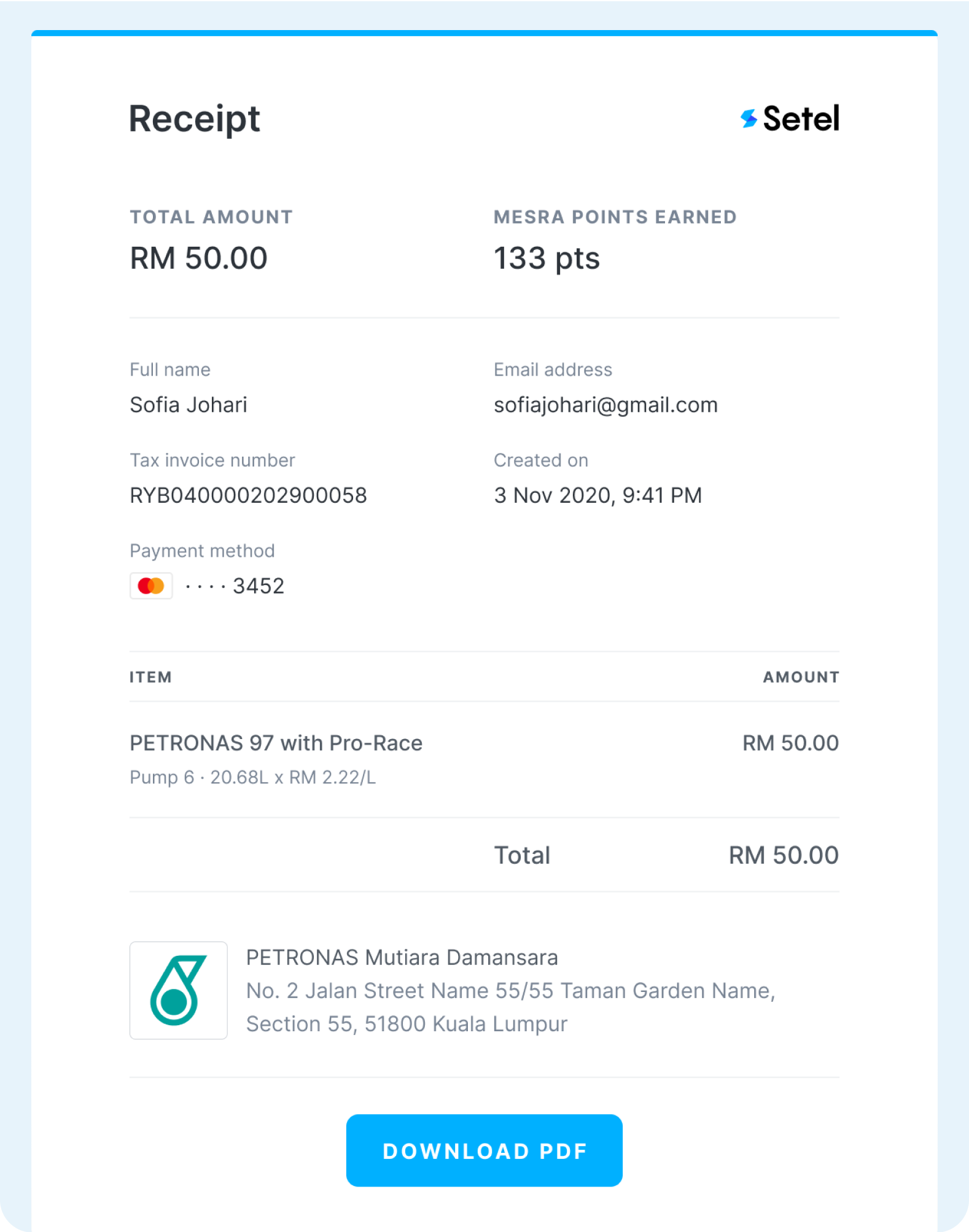

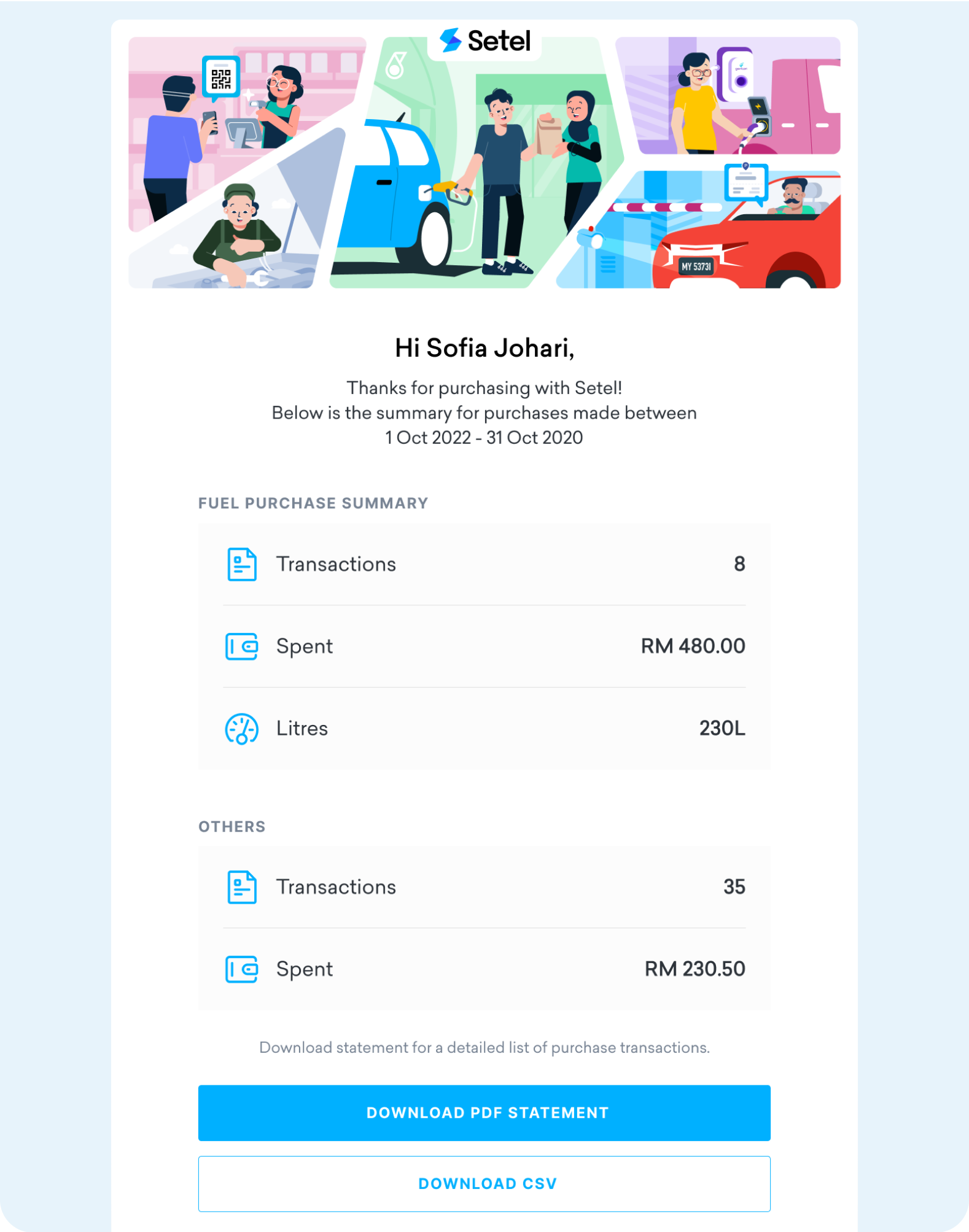

Customers can also link their preferred credit and/or debit cards to their Setel Wallet for direct deduction and charging to their cards where they can skip the constant need to reload their Setel Wallet via CardTerus. Most importantly, customers can better manage and monitor their spending by referring to the payment history in the Setel application.

The maximum limit for reload of the Setel Wallet is:

- RM500.00 (upon registration of an account); and

- RM5,000.00 (upon successful completion of the e-KYC process).

The maximum daily spending limit of transactions allowed with the Setel Wallet is:

- RM500.00 per transaction (excluding Setel Wallet reloads);

- RM2,000.00 per transaction (excluding Setel Wallet reloads and upon successful completion of the e-KYC process); and

- RM2,000.00 max per day (excluding Setel Wallet reloads)

2. What are the fees and charges I have to pay?

- The Setel mobile application is downloadable for free from the Apple Store, Google Play Store or HUAWEI App Gallery.

- No reload fee, refund fee or other fees will be charged to customers.

3. What are the key terms of this product?

- Customers can use the Setel Wallet to pay for their fuel purchases at PETRONAS stations, payment for items sold in Kedai Mesra and other retail purchases from participating merchants at their physical or online store.

- Customers can use the Family Wallet feature once the Setel Wallet Owner has successfully undergone the eKYC process.

- The Setel Wallet Owner may then select up to five (5) Family Wallet Members and he/she shall be responsible for his/her own selection of the Family Wallet Members.

- Family Wallet Owners can view and track their Members’ spending activities, limited only to the transactions made with the Owner’s Setel Wallet.

- The User must be eighteen (18) years old and above. If The User is below the age of eighteen (18) years, The User shall obtain The User’s parent or legal guardian’s consent prior to using the Setel application. The User’s parent or legal guardian shall be responsible for The User’s use of the Setel application and/or the services provided by Setel.

- The User is responsible for maintaining the security of The User’s log-in details, passcode, One-Time Password (OTP) and other information in relation to The User’s Setel Account. The User shall not share any personal details with any other parties.

- The User is responsible for all The User’s transactions made via the Setel application, including making regular checks on The User’s payment history regularly to ensure that The User’s account balance is correct and updated.

- The User’s Setel Account is personal to The User and therefore it shall be The User’s responsibility to ensure it is secure. Any instructions, confirmations and/or communications sent from The User’s account or device shall be deemed to have been issued by The User irrespective of whether the instructions, confirmations and/or communications were actually sent by The User.

- The User shall at all times ensure that The User has sufficient funds/balance to carry out any intended transaction through The User’s Setel Account.

- In the event of any fraud, misuse or abuse of account discovered to have occurred via the application, any remaining credit balance in The User’s Setel Account will be automatically forfeited upon deactivation of The User’s Setel Account and such credit balance shall not be refunded to The User.

- If any information provided by The User is untrue, inaccurate, outdated, or incomplete, Setel has the right to immediately terminate The User’s Setel Account and refuse all current or future use of the Setel Wallet.

- To use the auto assistance service, The User is required to share his/her name, phone number and vehicle plate number with the relevant Merchant providing such services. Any changes or cancellation requests made after payment has been completed shall not be accepted.

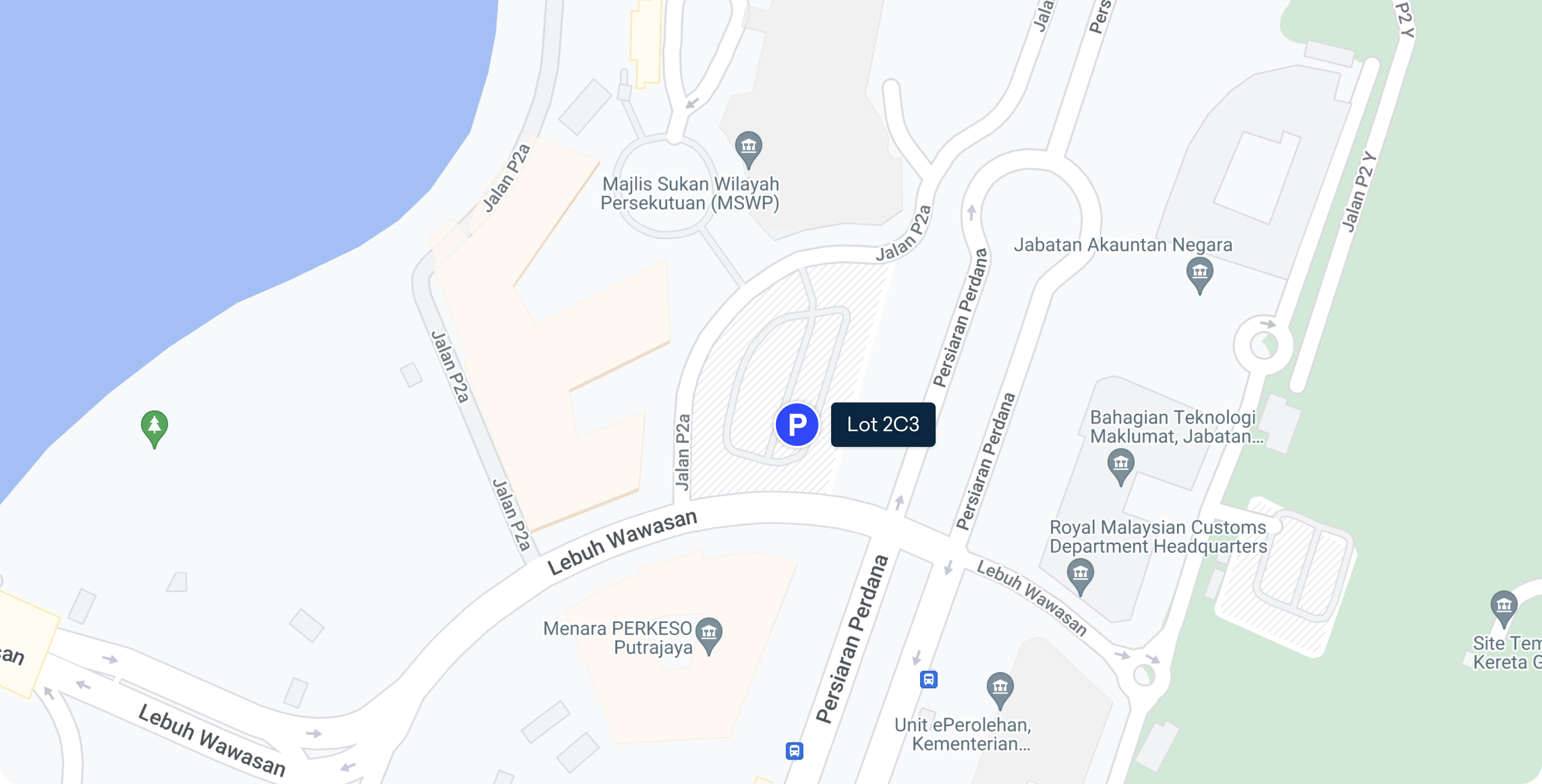

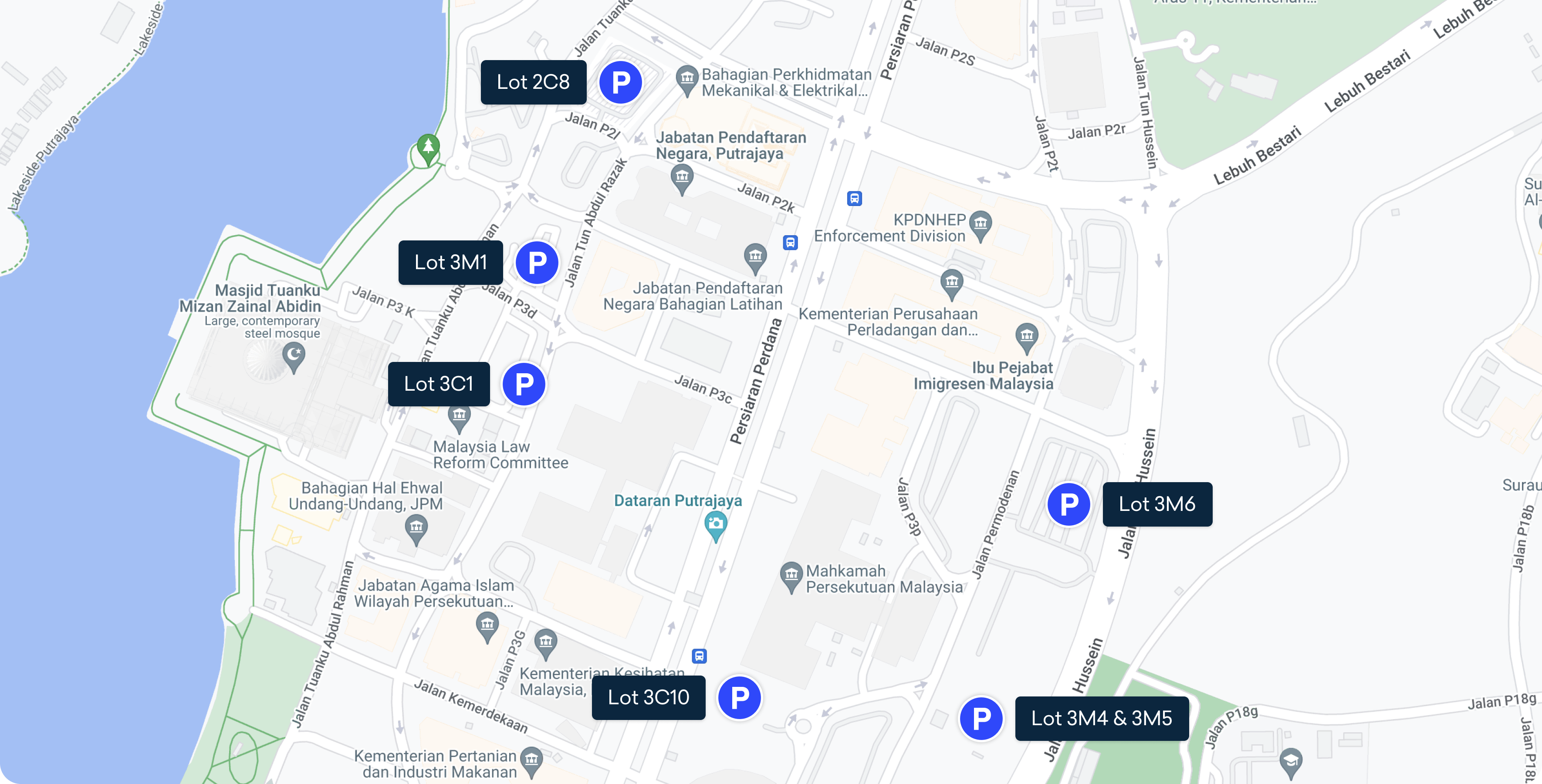

- To use the Setel parking feature, The User is required to first complete a one-time setup to authorise and to add his/her vehicle plate number(s) on the Setel App. The user is also responsible to ensure he/she has sufficient balance in the Setel account prior to exiting the parking lot.

- To use the Setel street parking feature, The User is required to select the parking location and the parking duration with the respective parking fee reflected. No changes or cancellations permitted after the payment process has been completed.

- To purchase or renew motor insurance via the Setel App, The User shall ensure that he/she fulfils all renewal criteria as set by the respective insurer, i.e Generali and Etiqa.

- For road tax renewals via the Setel App, The User is responsible to ensure that the vehicle is strictly for personal use only. The User is only allowed to apply for the 12-month road tax renewal as Setel currently does not cater to the 6-month renewal validity period.

- For road tax renewals via the Setel App, The User is required to pay for delivery and service fee and these shall be excluded from the road tax fee.

-

Customers can use the DuitNow P2P Transfer feature once he/she has successfully passed the eKYC verification process.

For more information on the terms and conditions, please refer to https://www.setel.com/terms

4. What are the major risks?

- In the event that The User’s mobile device is stolen, The User is required to contact us at hello@setel.com in a timely manner to enable us to temporarily suspend The User’s account from any fraudulent usage.

- Setel shall not be liable for any unauthorised usage prior to the date and time of receiving The User’s report.

- The User shall not expose or share The User’s passcode or OTP to a third party to avoid any fraudulent risks.

- Setel shall not be responsible for any wrongful selections, unauthorised use, losses, reversals, fees, claims, penalties, or chargebacks, incurred by the Setel Wallet Owner and Family Wallet Members.

- The User agrees and acknowledges that any transactions related to services provided by third-party merchants/partners/vendors shall be communicated to and dealt directly with the respective service provider.

- Please refer to Setel’s terms and conditions for further information on our Refund Policy.

- The User acknowledges that there are certain risks to consider when using the Petrol Credit Card, such as The User’s repayment capacity, and that by making only the minimum payment due, it can result in a lengthier repayment period and additional overall costs on top of the outstanding balance. Additionally, the finance charges imposed on the outstanding balance for the Petrol Credit Card is based on The User’s bank’s tiered pricing structure in accordance with The User’s repayment history.

- The User also acknowledges that there would be additional costs if The User uses his/her Petrol Credit Card to make repayment for other financing.

- The User is responsible for ensuring all payments due are timely made and that The User shall contact his/her bank in advance to discuss repayment alternatives in the event there are issues in settling the Petrol Credit Card’s outstanding balance.

- The User should notify his/her bank immediately in the event that the Petrol Credit Card is lost, stolen, utilised for an unauthorised transaction or if the PIN may have been compromised.

- The User is responsible for ensuring the accuracy of recipient information when initiating DuitNow peer-to-peer (P2P) transfers. For full details on the risks, please refer to the DuitNow QR Terms and Conditions.

5. What do I need to do if there are changes to my contact details?

It is strongly recommended that The User updates their latest information and contact details in the Setel application or submit The User’s updated personal details to hello@setel.com. This is to ensure timely and accurate correspondence and communication.

6. Where can I get further information?

If The User has any enquiries, please contact us at hello@setel.com or via our Live Chat on the app from Monday to Sunday 7.00am to 11. 00pm. More information is available on our website at www.setel.com

Address:

Setel Ventures Sdn Bhd,

Suite 11-01, Level 11,

Vertical Corporate Tower B,

Avenue 10, The Vertical,

Bangsar South City,

No 8, Jalan Kerinchi,

59200, Kuala Lumpur.

Tel: Message us on WhatsApp at +60 18-988 1333

E-mail: hello@setel.com

7. Other e-money products available.

Currently, there are no other e-money products offered by Setel.

NOTE: The information provided in this Product Disclosure Sheet is issued as at 26 Dec 2023 and will be valid until the next periodical review.

Product Disclosure Sheet

Please read this Product Disclosure Sheet before you (“The User”) decide to sign up for a Setel account. Be sure to also read the Privacy Statement and general Terms and Conditions.

i. Treat Customers Fairly Charter

Setel Ventures Sdn. Bhd. (“Setel”) and the Setel Group are committed to deliver good financial consumer outcomes to our customers. We believe in building long-term and mutually beneficial relationships with our customers and hereby pledge our commitment to provide the highest standards of fairness in all our dealings with our customers.

To keep our customers’ interests and financial well-being protected, we at Setel commit to the following:

- To embed fair dealing into our company’s corporate culture, code of conduct and core values;

- To ensure that customers are provided with fair and transparent terms which are well communicated to customers;

- To ensure that our staff, representatives, and agents exercise due care, skill and diligence when dealing with customers; and

- To ensure that customers are provided with clear, relevant and timely information on financial services and products.

Pursuant to the above, Setel has set out relevant and timely information of our products and services offered on the Setel application to help our customers make an informed decision on our current and upcoming offerings.

ii. Product Disclosure – Key Features

1. What is this product about?

Setel Ventures Sdn. Bhd. (“Setel”) is offering prepayment services via our electronic money application or electronic wallet namely, Setel Wallet. Customers can use Setel Wallet to pay for their fuel purchases at PETRONAS stations, payment for items sold in Kedai Mesra and other retail purchases from participating merchants at their physical or online store.

Customers can download the Setel mobile application from the Apple Store, Google Play Store or HUAWEI App Gallery and register to become a user (“The User”) to enjoy the benefits such as not having to queue up at PETRONAS stations to refuel their vehicles, to purchasing items from Kedai Mesra conveniently from their car seats, as well as making purchases from participating merchants.

Customers can reload their Setel Wallet via;

- Credit card: Top up using Visa or Mastercard;

- Debit card: Top up using debit card issued by domestic banking institutions;

- FPX: Top up using internet banking channel;

- Boost Wallet; online top-up using Boost Wallet;

- GrabPay; online top-up using GrabPay Wallet;

- ShopeePay; online top-up using ShopeePay Wallet;

- Setel Vouchers; or

- Mesra points.

Reload of the Setel Wallet can be automated using a credit card or debit card with the auto top-up feature. The cap on the reload is based on the threshold set or a one-off reload transaction limit.

Customers can also link their preferred credit and/or debit cards to their Setel Wallet for direct deduction and charging to their cards where they can skip the constant need to reload their Setel Wallet via CardTerus. Most importantly, customers can better manage and monitor their spending by referring to the payment history in the Setel application.

The maximum limit for reload of the Setel Wallet is:

- RM500.00 (upon registration of an account); and

- RM5,000.00 (upon successful completion of the e-KYC process).

The maximum daily spending limit of transactions allowed with the Setel Wallet is:

- RM500.00 per transaction (excluding Setel Wallet reloads);

- RM2,000.00 per transaction (excluding Setel Wallet reloads and upon successful completion of the e-KYC process); and

- RM2,000.00 max per day (excluding Setel Wallet reloads)

2. What are the fees and charges I have to pay?

- The Setel mobile application is downloadable for free from the Apple Store, Google Play Store or HUAWEI App Gallery.

- No reload fee, refund fee or other fees will be charged to customers.

3. What are the key terms of this product?

- Customers can use the Setel Wallet to pay for their fuel purchases at PETRONAS stations, payment for items sold in Kedai Mesra and other retail purchases from participating merchants at their physical or online store.

- Customers can use the Family Wallet feature once the Setel Wallet Owner has successfully undergone the eKYC process.

- The Setel Wallet Owner may then select up to five (5) Family Wallet Members and he/she shall be responsible for his/her own selection of the Family Wallet Members.

- Family Wallet Owners can view and track their Members’ spending activities, limited only to the transactions made with the Owner’s Setel Wallet.

- The User must be eighteen (18) years old and above. If The User is below the age of eighteen (18) years, The User shall obtain The User’s parent or legal guardian’s consent prior to using the Setel application. The User’s parent or legal guardian shall be responsible for The User’s use of the Setel application and/or the services provided by Setel.

- The User is responsible for maintaining the security of The User’s log-in details, passcode, One-Time Password (OTP) and other information in relation to The User’s Setel Account. The User shall not share any personal details with any other parties.

- The User is responsible for all The User’s transactions made via the Setel application, including making regular checks on The User’s payment history regularly to ensure that The User’s account balance is correct and updated.

- The User’s Setel Account is personal to The User and therefore it shall be The User’s responsibility to ensure it is secure. Any instructions, confirmations and/or communications sent from The User’s account or device shall be deemed to have been issued by The User irrespective of whether the instructions, confirmations and/or communications were actually sent by The User.

- The User shall at all times ensure that The User has sufficient funds/balance to carry out any intended transaction through The User’s Setel Account.

- In the event of any fraud, misuse or abuse of account discovered to have occurred via the application, any remaining credit balance in The User’s Setel Account will be automatically forfeited upon deactivation of The User’s Setel Account and such credit balance shall not be refunded to The User.

- If any information provided by The User is untrue, inaccurate, outdated, or incomplete, Setel has the right to immediately terminate The User’s Setel Account and refuse all current or future use of the Setel Wallet.

- To use the auto assistance service, The User is required to share his/her name, phone number and vehicle plate number with the relevant Merchant providing such services. Any changes or cancellation requests made after payment has been completed shall not be accepted.

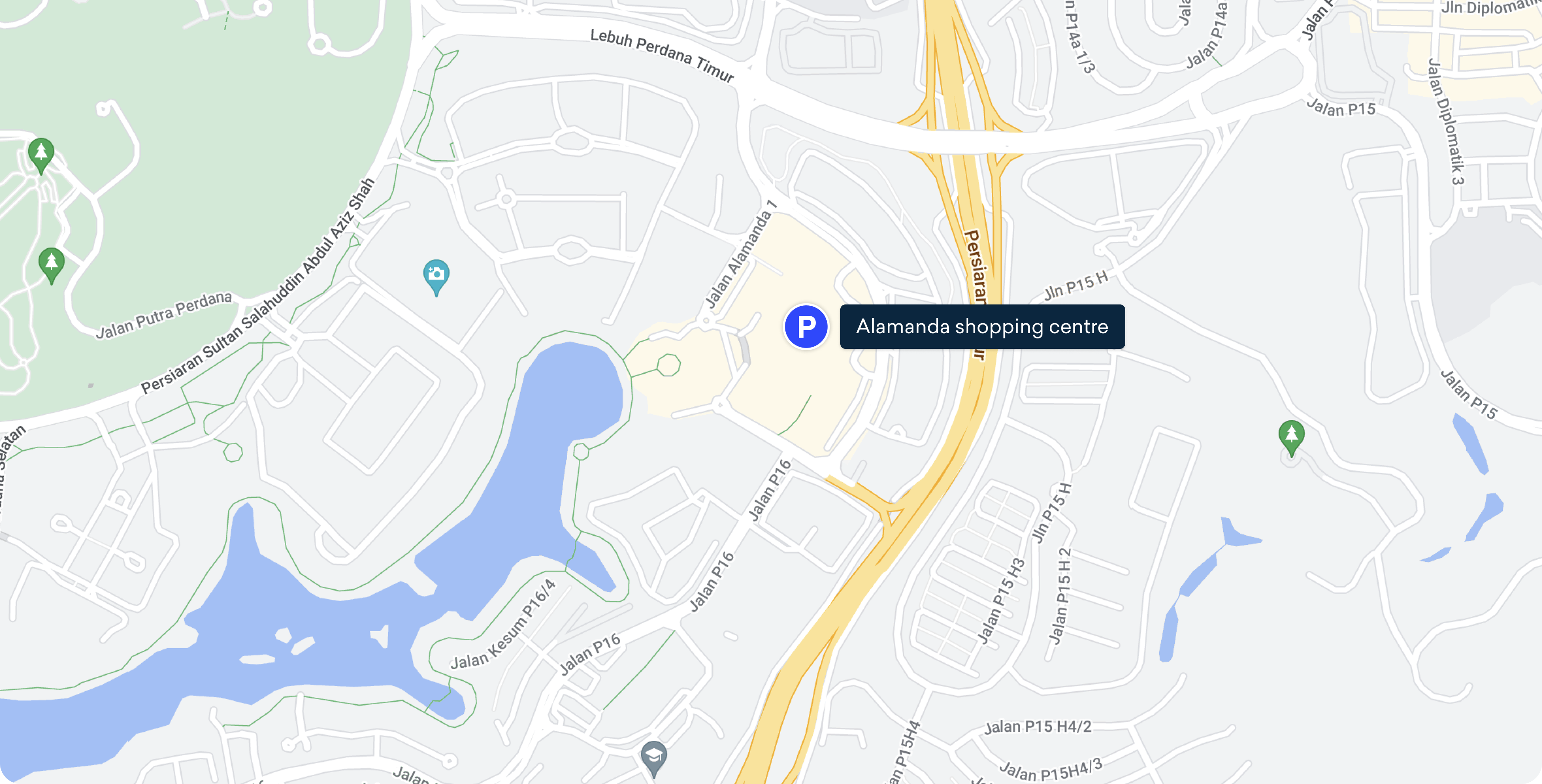

- To use the Setel parking feature, The User is required to first complete a one-time setup to authorise and to add his/her vehicle plate number(s) on the Setel App. The user is also responsible to ensure he/she has sufficient balance in the Setel account prior to exiting the parking lot.

- To use the Setel street parking feature, The User is required to select the parking location and the parking duration with the respective parking fee reflected. No changes or cancellations permitted after the payment process has been completed.

- To purchase or renew motor insurance via the Setel App, The User shall ensure that he/she fulfils all renewal criteria as set by the respective insurer, i.e Generali and Etiqa.

- For road tax renewals via the Setel App, The User is responsible to ensure that the vehicle is strictly for personal use only. The User is only allowed to apply for the 12-month road tax renewal as Setel currently does not cater to the 6-month renewal validity period.

- For road tax renewals via the Setel App, The User is required to pay for delivery and service fee and these shall be excluded from the road tax fee.

For more information on the terms and conditions, please refer to https://www.setel.com/terms

4. What are the major risks?

- In the event that The User’s mobile device is stolen, The User is required to contact us at hello@setel.com in a timely manner to enable us to temporarily suspend The User’s account from any fraudulent usage.

- Setel shall not be liable for any unauthorised usage prior to the date and time of receiving The User’s report.

- The User shall not expose or share The User’s passcode or OTP to a third party to avoid any fraudulent risks.

- Setel shall not be responsible for any wrongful selections, unauthorised use, losses, reversals, fees, claims, penalties, or chargebacks, incurred by the Setel Wallet Owner and Family Wallet Members.

- The User agrees and acknowledges that any transactions related to services provided by third-party merchants/partners/vendors shall be communicated to and dealt directly with the respective service provider.

- Please refer to Setel’s terms and conditions for further information on our Refund Policy.

- The User acknowledges that there are certain risks to consider when using the Petrol Credit Card, such as The User’s repayment capacity, and that by making only the minimum payment due, it can result in a lengthier repayment period and additional overall costs on top of the outstanding balance. Additionally, the finance charges imposed on the outstanding balance for the Petrol Credit Card is based on The User’s bank’s tiered pricing structure in accordance with The User’s repayment history.

- The User also acknowledges that there would be additional costs if The User uses his/her Petrol Credit Card to make repayment for other financing.

- The User is responsible for ensuring all payments due are timely made and that The User shall contact his/her bank in advance to discuss repayment alternatives in the event there are issues in settling the Petrol Credit Card’s outstanding balance .

- The User should notify his/her bank immediately in the event that the Petrol Credit Card is lost, stolen, utilised for an unauthorised transaction or if the PIN may have been ompromised.

5. What do I need to do if there are changes to my contact details?

It is strongly recommended that The User updates their latest information and contact details in the Setel application or submit The User’s updated personal details to hello@setel.com. This is to ensure timely and accurate correspondence and communication.

6. Where can I get further information?

If The User has any enquiries, please contact us at hello@setel.com or via our Live Chat on the app from Monday to Sunday 7.00am to 11. 00pm. More information is available on our website at www.setel.com

Address:

Setel Ventures Sdn Bhd,

Suite 11-01, Level 11,

Vertical Corporate Tower B,

Avenue 10, The Vertical,

Bangsar South City,

No 8, Jalan Kerinchi,

59200, Kuala Lumpur.

Tel: Message us on WhatsApp at +60 18-988 1333

E-mail: hello@setel.com

7. Other e-money products available.

Currently, there are no other e-money products offered by Setel.

NOTE: The information provided in this Product Disclosure Sheet is issued as at 25th May 2023 and will be valid until the next periodical review.